I've racked up a sizable debt from gambling the past several years. Is it just me or is it so much harder to stop when you know you've got a large debt to pay off.

I think its easier to stop when u've lost (for example) 50k in savings but you've got no debts to pay than to lose 20k but be in debt. I want a fresh start but then I look at my bank balance and go.......NO, I will only get a fresh start when I pay off my debts.

It is not uncommon for family and friends of someone with a gambling problem to be completely unaware of gambling-related debt until a court summons arrives for non-payment, or in dire circumstances even repossession orders for the family home. Financial problems can mount up very quickly. Bills don’t get paid, debts accumulate. The gambling and debt meant I missed out on things. Even simple ones like driving! I’ve never done a driving lesson or driven a car in my life. Because I was in so much debt, I couldn’t ever make it a priority. So I want to focus on that next. The other one is everyone’s pipe dream, which is saving up to get my own place one day!

They don’t want to make sacrifices. Could you give up eating out three nights a week?

I know its going to take me several years to pay off and I always think the only way to escape this situation is to to gamble more. I'm stuck in my job right now and there's no way to get out. Its like as if im trapped, trapped in an imaginary jail right now.

Is anyone experiencing the same thing as I am? Where u find it harder to stop because you are in debt?

Let us face facts, Millennials are the face of America these days and including them, most Americans out there are immersed knee-deep in debt. Why do you think that is? We have compiled a list of reasons which will try to explain some of the main reasons why we see so many indebted Americans lately.

If you are one of these unfortunate Americans who find themselves unable to pay off their debts and loans, you should try to hire a debt relieving advisor in person or get their services online from a website such as https://www.facethered.com/

Student Loans

College funding has become very expensive as of late and it is difficult for parents and students to pay it all off at once. This is why students take loans as financial aid and all to help them get through college and obtaining a degree. After they have received their degree, they have to work for a long time to pay off their entire loan. This is because they not only have to pay off the loan with their money, they also have to pay their living expenses such as rent and food. Most students are not able to save anything in the process. When these students finally pay off all their loans and emerge into their seemingly debt-free lives, they are hardly left with any savings to their name which will help them maintain themselves in this life. This is why they turn towards taking more debt which can keep accumulating throughout the person’s life.

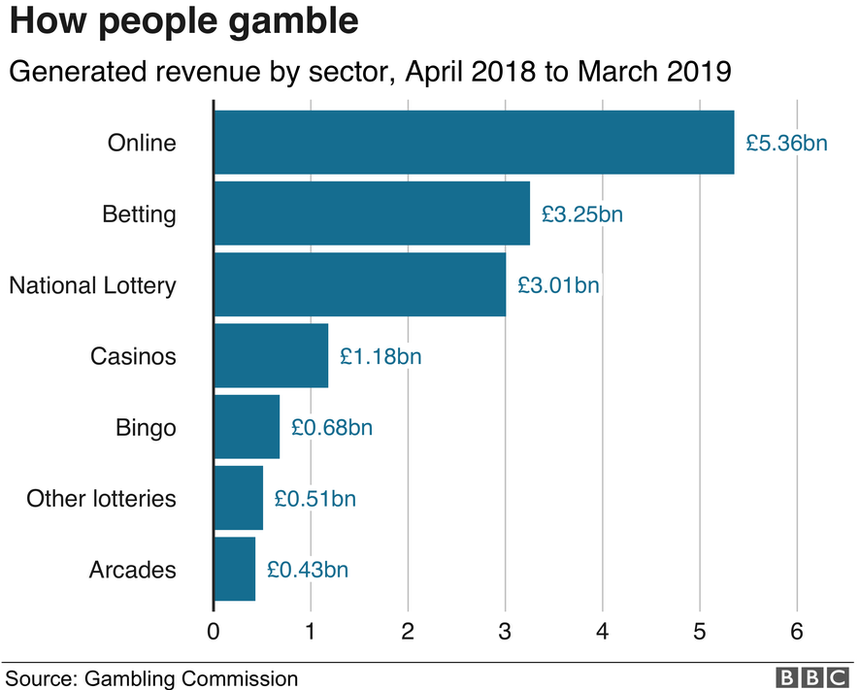

Gambling

Another big reason which throws Americans into debt is the toxicity of gambling. Gambling has become an addiction for many Americans who spend long hours of their day in bars, clubs and casinos trying to make a fortune for themselves and losing most of their money in the process. Some people get so addicted to gambling that they mortgage their properties and ask for loans to pay off the money they owe or worse, to play games with even higher stakes.

Unemployment and Minimum Wage

Gambling Debt Loan

Gambling Debt Facts

Unemployment is at an all-time high in the USA. Many people who could not put themselves through college or have liberal arts degrees and the likes find it very difficult to find stable jobs. Many of these people therefore work in Fast Food joints and all at minimum wages to make ends meet. In these situations paying off rent, bills and buying food for themselves is pretty much all they can manage and have to eventually turn towards debt to live a normal life

Help With Gambling Debt

Divorces

Lastly, Divorce is a great reason why people become immersed in debt. This is because roughly 50% of all marriages in the USA end in divorce and people take signing a pre-nuptial agreement very personally. Hence, a divorce usually makes the people involved fall into debt and with the payment of monthly alimony and care for the children involved, the person finds himself borrowing more and more money.

Comments are closed.